Have you experienced the embarrassing feeling of being turned down for

a home or auto loan or maybe even denied a place to live or a job because your “Credit Score” is “Too Low”?

Discover the little known “secrets” of the credit industry and how you can easily and quickly

boost your credit score by as much as 200 points, in 60-days or less, even if you have bad credit

or no credit, without spending 1000’s of dollars with credit repair companies!

I have an important question that I’d really like to ask you, if that’s alright?… (If so, then just keep reading.)

I know that this is a little bit of a personal question, however, it’s for a very good reason, and you’ll discover why in just a moment.

Have you ever missed out on a valuable opportunity, just because you have a low Credit Score?

Or maybe you’ve experienced the unsavory taste of high interest-rates, and you know that you’re overpaying on your loans, because you have a Low Credit Score?

How about if you’ve ever been turned down for a job or even an apartment, all because your score is too low?

Do you currently struggle with having a Low Credit Score?

If so, then don’t kick yourself in the derriere, because you’re simply standing alongside the 41+ Million people within the United States who also struggle with having bad Credit…

Now, before I get any farther, let me just clear the air really quick, and say that. No, this is not going to be a pitch for Credit Repair services or professional financial help, this is far from it and you’ll learn why in just a second.

I’m currently writing this letter, because I want to share with you this completely “hidden” strategy that is being utilized by tens of thousands of people all around the country to fix their credit scores and add as much as 200-points to their score in 60-days or less!

I recently came across this strategy and it’s typically used by the “Credit Professionals” in the industry, and consumers will pay these people thousands of dollars to do it for them.

(Also, this is NOT Credit repair and/or negative reporting correction! It’s actually much simpler and easier…)

Here’s the best part though…

You can do it 100% on your own, WITHOUT having to hire a “Credit Professional” to do it for you!

You can get started as soon as you want, completely on your own, and get it done in record time!

(Keep reading to learn more)

The unfortunate and brutal reality is…

Without good credit, you’re basically screwed, and at one point in their life, nearly everybody has,

- Been late to make payments on loans or cards

- Had an overdue student loan.

- Had high credit card balances.

- Had collection accounts, etc.

- Or even had a foreclosure!

Sadly, all of these things will take a negative toll on your credit score, and having bad credit can impact very important aspects of your life.

When you have bad credit it becomes difficult (if not impossible) to be approved for loans, rent a new apartment, buy a car, or even be accepted for a good job opportunity!

As well, having “lousy” credit can also make your life MUCH more expensive…

Did you know that you will pay hundreds of thousands of dollars MORE in interest, in your lifetime, just from a low credit score?

Not to mention that if you’re able to take out an auto loan or mortgage with low credit, they will most likely take advantage of you and make you pay a much higher interest rate, because that’s how they make their money…

Fact: The average person with a score of 620 or lower will pay around

$500,000 OR MORE just in interest over their lifetime!…

Honestly, it really doesn’t seem fair…does it?

You can end up paying around half a MILLION dollars or more in your lifetime, just due to interest rates…

This is your hard earned money that is just being taken away from you, and $500,000+ is a large chunk of cheddar!

Imagine it in your head, this can be enough for you to FINALLY get that dream car, buy a family home, pay for your children(s) college tuition, pay off your debts, or maybe even taking that life-long vacation you’ve always been wanting…

A low credit score means a lifetime of paying more interest and not being able to afford some of the things that you want in life.

Are you starting to understand how substantial this problem is?

Are you starting think about how much of your money you might be currently losing, just by having a low credit score?…

If so, then don’t worry, because I’m going to show you how to fix this exact problem that is plaguing over 41-million people in America.

Here are some of the ways that you can fix your Credit Score…

Now, as you probably know, there’s few ways you can raise your Credit Score by a handful of points here and there. However, the process can usually take 6, 12, 24-months or longer, just to add 50 or so points to your score…

You can start to do things like begin to build “Positive Credit-lines”, by being extremely sharp and on-time with making payments on certain lines of credit, installment loans, etc.

Having a few lines of credit, where you’ve been very good at making payments on-time, will look very good on a credit report.

This will absolutely pay off for you down the road, but for some people, they need to fix their credit ASAP, not in 6-months to 2-years.

As well, you can also take the long, (But effective) path of “Correcting Negative Reporting” and utilizing “Consumer Protections Laws”.

But for most people, all of that complicated legal language is a nightmare to understand, and might as well be a Swahili & Pig-Latin hybrid.

When it comes to using this strategy, your best chances are to hire a professional, which unfortunately is not optimal for most people in their particular situations.

These strategies will work for you, but they take some time to start seeing results and you probably need to out-source and pay for professional help…

However, Here’s Your Solution To This Problem…

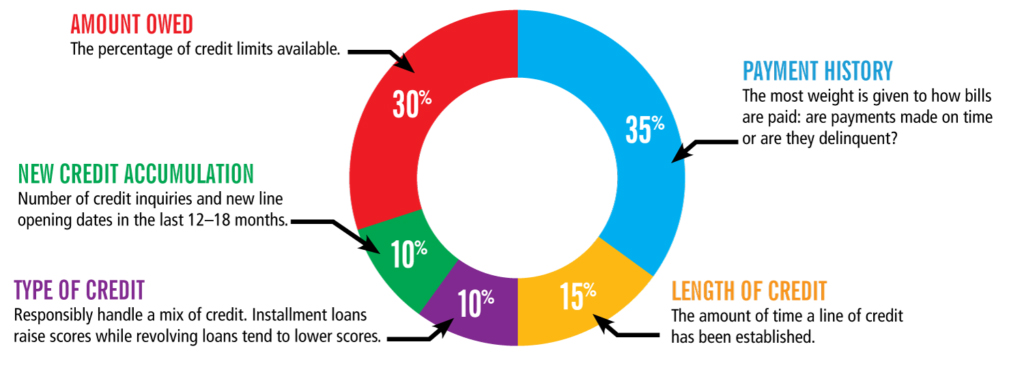

The Easiest And Fastest Way You Can Start Raising Your Credit Score, Is By Lowering Your “Credit Utilization Ratio” And “Stack Your Credit”.

(This counts for 1/3rd of your credit score. So please pay attention, because this is very important… yes, one third!)

“Lowering your credit utilization ratio” also called “Credit Stacking” is the process of acquiring additional lines of credit, in order to increase the amount of credit available to you. (But the goal is NOT to spend it. Let me explain why.)

The goal, is to have a high amount of credit available to you, relative to the amount of credit that you owe.

For example, let’s say you have $5,000 in total available credit, and you owe $3000. That means you’re using 60% of your credit, which does NOT look good on a credit report.

Now, if you’re able to get approved for an additional $10,000 in credit and bring your total available credit to $15,000 and you still owe that $3,000. Well, now you’re only using 20% of your available credit, and you just lowered your ratio by 2/3rd’s!

This is a MASSIVE difference and this alone can easily add 50-100+ Points to your credit score in just a few weeks!…

According to credit bureaus like Fico, Equifax, Experian, etc. This ratio of makes up 30% of your credit score, which can make a massive difference…(Reference the pie chart below)

Just by improving this one area is the easiest and fastest way that you can start raising your credit score, without having to hire professionals or perform credit repair, negative reporting correction, etc.

I know this almost seems too good to be true, but it’s very real and it’s working!…

Tens of thousands of people all around the country have been using this 1 golden-strategy FOR YEARS, to fix their credit score and do things like:

- Get approved for valuable lines of credit with benefits (Cash Back, Air Miles, etc.)

- Lower their current interest rates after refinancing.

- Be accepted for better job opportunities.

- Get approved for new housing.

- Buy a new car and much more!

Now, with this strategy, there are a few things that you need to know in order to execute it properly, and you might be asking yourself things like:

- “What if I can’t get approved for more credit?”

- “What are the right lines of credit to apply for?”

- ”How do I do this strategically?”

- “How do I know if I’m doing it right?”

Well, these are the exact problems that are solved in the proven ScoreZoom® program!

Now, with this strategy, there are a few things that you need to know in order to execute it properly, and you might be asking yourself things like:

- “What if I can’t get approved for more credit?”

- “What are the right lines of credit to apply for?”

- ”How do I do this strategically?”

- “How do I know if I’m doing it right?”

Here’s Everything You Receive When You Join our ScoreZoom® Program Today:

Instant access to our membership area will allow you to get started right NOW!

Our ScoreZoom® DIY Credit Raising Program:

Inside, you’ll have full access to 40+ Secret Primary Lines of Credit, up to $50,000 and simple installment loans opportunities! Simply choose the ones you need, click the submit button, and be taken to the appropriate website, fill out your information and once approved you’ll be one step closer to a higher credit score. Most require no credit checks and come with instant approval.

Quick Start Guide and Training:

You will receive a Quick-Start Guide PDF & training video that will instruct you on exactly what to do first, second, and third, in order to get the maximum results from the program depending based on your specific needs and circumstances!

List of 40+ “Hidden” Lines of Credit and Installment Loans:

You’ll be given immediate access to a secure page where you can access 40+ lines of credit from credit cards, installment loans and other financial instruments with the sole goal to get you approved immediately, many with no credit check required. These are simply point and click.

“Seven Weeks to 700” PDF E-Book:

This is a special bonus we’ve included just for you. We’ve included an E-book written by one of our founders that literally has sold tens of thousands of copies, helping people to repair their credit. it’s a step by step guide and includes many form letters you can use yourself if you need help with credit repair.

Private Membership Area Access:

Get immediate access to all the reports and training in our private members area. We will also post all the training calls and keep this updated with current information and new lines of credit access whenever we find one we feel is right for our members.

Exclusive Access To Our Private FB Group:

You will be given a link to access to our Private Facebook™ Group, where you can connect with other like minded people going through the program. We will share tips & tricks, and ask/answer questions! *Program announcements will be posted in the group* In addition, we will hold FB lives and webinars.

Members Only Group Coaching Calls:

Currently we will do once a month calls where we will answer all your questions live. Imagine getting access to the experts that charge thousands of dollars normally.

And if you can’t make it to the live calls, the calls will be recorded and stored in the private members area for you to watch at your leisure, whenever you want!

We’ve been leaders in the Industry for over 15 years.

For over 15-years we’ve been professionally executing these exact same strategies and tactics for people just like yourself, working with them as clients, and they pay us thousands of dollars to do so.

However, we realized that we were very limited in the amount of people that we could help with this “Done-for-you” type of model.

We realized that we could help millions of people, by creating a DIY system that teaches people like yourself how to do the same thing completely on your own, and save you thousands of dollars as well!

This is exactly why we created our ScoreZoom® Program!

We will take you by the hand and guide you through the step-by-step system to eliminate any possible confusion, that way you can start executing this system ASAP!

In fact, we’ll have live monthly calls where you can speak with one of our trained experts that will answer all your questions live, and help you that much more 100% for free as a bonus.

And if you can’t join the live calls, don’t worry! They will all be recorded and hosted in the members area, so you will be able to watch them at your convenience, as many times as you want!…

You will also have access to our Private Facebook™ Community where you can ask questions, and connect with other like minded people going through the program and get/give advice!

This is a rare, one of a kind opportunity that you will not find anywhere else other than right here at ScoreZoom®!

And we’re so confident that we can help you raise your credit score in less than 60-days, that we provide you with a full, 60-day 100% money-back guarantee, and are even going to give you the program for almost half of its original price!

Limited Time Opportunity: Get our ScoreZoom® Program for 40% off of it’s full price! (Instantly Save $297)

Regular Program Price: $497

Limited Time Opportunity: Only $297!

Here are a few words from some our ecstatic customers!

Still want to look at more testimonials? We’ve got plenty!

Click the button to view more!

FAQ

Q: “How many credit lines should I get for myself?”

Only you know for sure. On average you can add 5-8 of these personal loan/credit lines and get a score increase from each.

Q: “What do they cost?”

Each personal loan/credit line has a different cost. Some are FREE! Others have nominal fees just like a normal credit card will have.

Remember you are in a challenging credit situation. You must take this into account. The lender is assuming a lot of risk when they extend you credit.

Q: “Will there be an inquiry on my credit?”

Sometimes there will be a hard inquiry on your credit. Most of the time there won’t be an inquiry at all. Look for those offers. If they fit your needs, enroll!

Q: “How long until they post to my credit report?”

Some can post in a few days depending on when you are approved in relation to the vendors reporting cycle. We have several offers that are guaranteed to report on either the 1st or the 15th.

Q: “How many points will they give me?”

You could get as little as ten points. You could get as much as 90 points. Remember, if you apply for credit that promotes “as much as” 90 points, and you already have a 740 credit score, you are NOT going to get 90 points. You’ll get more like 25-40.